A resource for those seeking information on organizing and transforming spaces.

5 Steps For Organizing Your Finances

From organizing the living room to getting the kitchen in order, there are a lot of things that beg for your attention on a regular basis. It’s easy to spend all our efforts focused on the things we have to look at every day, but there are other areas of life that deserve just as much attention. Your finances being one of them.

From organizing the living room to getting the kitchen in order, there are a lot of things that beg for your attention on a regular basis. It’s easy to spend all our efforts focused on the things we have to look at every day, but there are other areas of life that deserve just as much attention. Your finances being one of them.

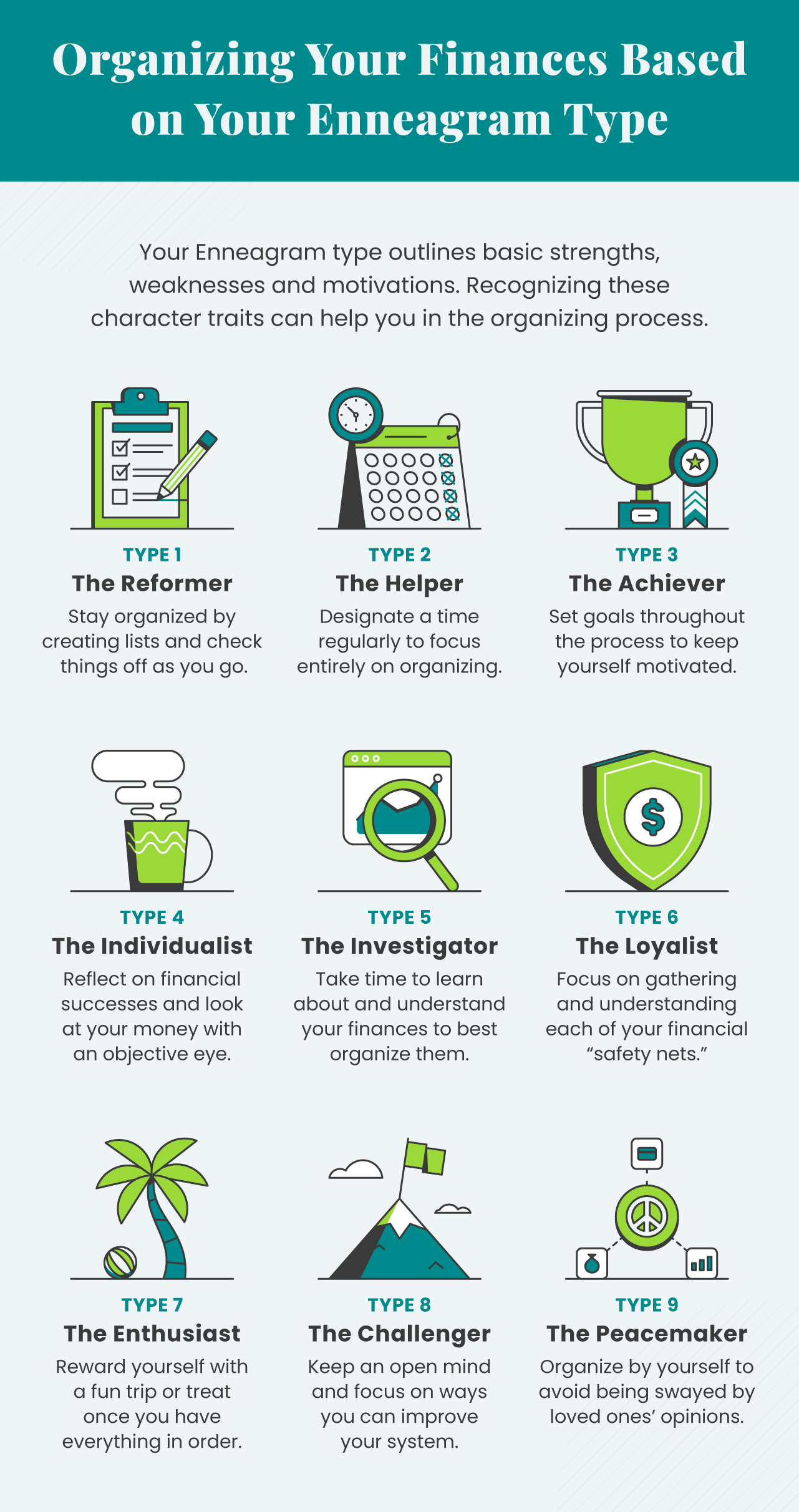

By spending adequate time getting your finances in order, you’ll be better able to pay bills on time, you’ll stress less, and you’ll have more time to spend focused on what matters most. There are many ways and methods for organizing. First look through the Enneagram chart below to get a better sense of what you should focus on based on your personality type.

Once you understand how you best organize, follow the following five steps.

1. Gather All Your Financial Documents

Knowing where your important financial documents are can lessen stress during emergencies. Be sure to organize both your paper documents and your digital documents. You can arrange them by date, category, or whatever other way helps you.

You may also want to consider scanning paper documents and uploading them onto a hard drive. You’ll then want to put this drive into a safe for protection. This will help you get rid of excess paper storage while also protecting your confidential documents.

2. Set-Up Automatic Bill Pay

By setting up automatic payments, you won’t have to spend the extra time worrying if you’ve forgotten to pay your bills. Utilizing automatic payments is one of the most effective ways to organize your bill-paying system.

Not all your bills may have an automatic payment option. For the ones that don’t, consider marking the day they need to be paid on a calendar you look at often. It can also be helpful to set up reminders in your phone.

3. Set a Recurring Date to Review Your Finances

By designating a specific date each month to review your finances, you’ll be able to better protect yourself from fraud and overspending. Doing a regular check-up will help you see where you’ve spent your money and how much you have left in your budget.

Set up reminders in your phone or project management app so you don’t forget. You can also use a paper calendar if you use it often and it will act as an efficient reminder.

4. Use a Finance App

Most people have more than one account to keep track of. From your checking account to your retirement accounts, it can be difficult to know what’s happening with each one of them. By using a finance app, you can better keep track of your overall financial picture. Many of these apps even have additional features that can help you track your net worth.

5. Create An Income Timeline

Creating an income timeline can help you set goals for your financial future. This is an especially beneficial way to organize your finances during retirement, as you’ll likely have access to different funds at different times.

Use this free printable from Annuity.org below to create your income timeline.

Getting your finances organized can seem like a daunting task, but it doesn’t have to be. Taking the plunge and getting started is often the hardest part, but knowing exactly what you need to focus on can help you break through the mental barrier and get your finances in order once and for all.

Sell or Rent: How To Decide What To Do with Your House

When it’s time to move, it’s also time to decide what to do with the house you’re in. There are two options: sell the house or become a rental property owner.

Moving is both an exciting and stressful time. One of the biggest decisions to make is whether to sell your home or use it as a rental property. Both options have pros and cons, and it’s best to understand how to decide whether to sell or rent so that you can make the right decision for your family.

Consider Your Neighborhood

Take a look around your neighborhood: it’s possible that your neighborhood doesn’t attract renters very well. Or, if you have a high mortgage, you may have to ask for a high rent, which can deter potential renters. In that case, selling the home is the better option.

On the other hand, what’s the housing market currently like? Your realtor will know the temperature of the current market, so be sure to ask. If houses aren’t selling but people are desperate for rentals, it may be worth it to see if you can find a renter instead.

Consider Your Timeline

How much time you have before the move affects your decision about whether it’s best to sell or rent your home. If you’re in a hurry, you may not have the time to prepare your home to rent. Although selling requires preparation as well, renting out your home has its own set of steps to make sure it’s ready for the renters.

Determine Whether You’re Landlord Material

You can’t just rent out your home and forget about it the way you would if you sold the house. The property is still your responsibility, as are the renters. If owning rental property has always intrigued you, then renting out your home is a great way to start a property investment portfolio. However, if you aren’t prepared to manage the property by keeping track of rent, maintaining the property, and searching for new renters when necessary, then put the house on the market instead.

When you’re making the decision whether to sell or rent, keep these three things in mind: the neighborhood, your timeline, and the responsibility of owning a rental. Weigh the pros and cons for each, and you’ll reach the decision that’s best for you.

Outdoor Design Trends for a Private Backyard Sanctuary

Having a beautiful backyard to relax and unwind is just about every homeowner's dream — that is unless you live near a busy street or have neighbors with a clear view into your backyard.

Having a beautiful backyard to relax and unwind is just about every homeowner's dream — that is unless you live near a busy street or have neighbors with a clear view into your backyard. Thankfully, there’s plenty of backyard privacy solutions available so you can enjoy your yard without feeling like a goldfish in a bowl. If you want to upgrade your garden, check out these backyard design trends to give you that outdoor haven you’ve always wanted.

Stylish Privacy Installation

There’s so many different ways to add privacy without losing the aesthetic of your backyard. From decorative panel screens to lush plant walls, the possibilities are endless. Check out some trendy design inspiration below.

Garden Retreat

Plants are a great way to add privacy to your backyard while creating a natural ambiance. If your dream backyard consists of whimsical flowers, lush vegetation, and a cozy gazebo to enjoy in your free time, then check out some inspiration to transform your backyard into the secret garden retreat you’ve always dreamed of.

Steps To Clean Up Your Home After a House Fire

If you’ve experienced a house fire, the cleanup process might seem overwhelming. Start with these steps to clean up your home and get back to normalcy.

A house fire is one of every homeowner’s worst nightmares. If you’ve experienced a fire, you may not know where to start when it comes to cleanup. However, when you break it down, the cleanup process becomes a lot easier to process. When the smoke has cleared and it’s safe to enter, here are some steps to clean up your home after a house fire.

What To Throw Away

When it comes to cleaning up after a fire, a safe place to start is by throwing away what you can’t save. Some items are downright dangerous to hold onto after experiencing fire damage, such as electrical cords to appliances and tech, food, medicine, and furniture. Textiles such as carpeting, blankets, and mattresses can hold onto smoke odors and soot, so don’t keep them. Once you’ve cleared out your damaged belongings, you can start to clean the rest of the house.

How To Get Rid of the Smoke Smell

The next step to clean up your home after a house fire is to take care of smoke damage. Smoke damage from house fires can cause a lingering smokey smell that’s unpleasant as well as unsafe. Remove everything you can that smells like smoke—such as furniture—and treat what you can’t. Start by getting some circulation into your home. You can open windows or use portable fans (if it’s safe to use your electrical outlets). It’s essential to tackle the smoke smell as soon as possible—because the longer you leave it alone, the harder it’ll be to remove later.

Getting Rid of Soot Stains

Soot removal is essential to the future health of your home and its inhabitants. Soot contains chemicals and particles from the fire and can hang onto your walls, flooring, and furniture because of its oily texture. It also attributes to the smokey smell in your home and can be dangerous to breathe in for long periods of time, so do your best to remove it. You can use a heavy-duty shop vac to remove most of the soot residue. For resilient cases of soot and lingering smoke odors, you may want to call in a professional restoration company.

If you’ve experienced a recent house fire and don’t know where to start, try following these steps. It’s important to try to tackle the cleanup process early, to avoid any lingering effects, like smoke smell and soot. By following these tips, you can help your home on the way to recovery.