5 Steps For Organizing Your Finances

From organizing the living room to getting the kitchen in order, there are a lot of things that beg for your attention on a regular basis. It’s easy to spend all our efforts focused on the things we have to look at every day, but there are other areas of life that deserve just as much attention. Your finances being one of them.

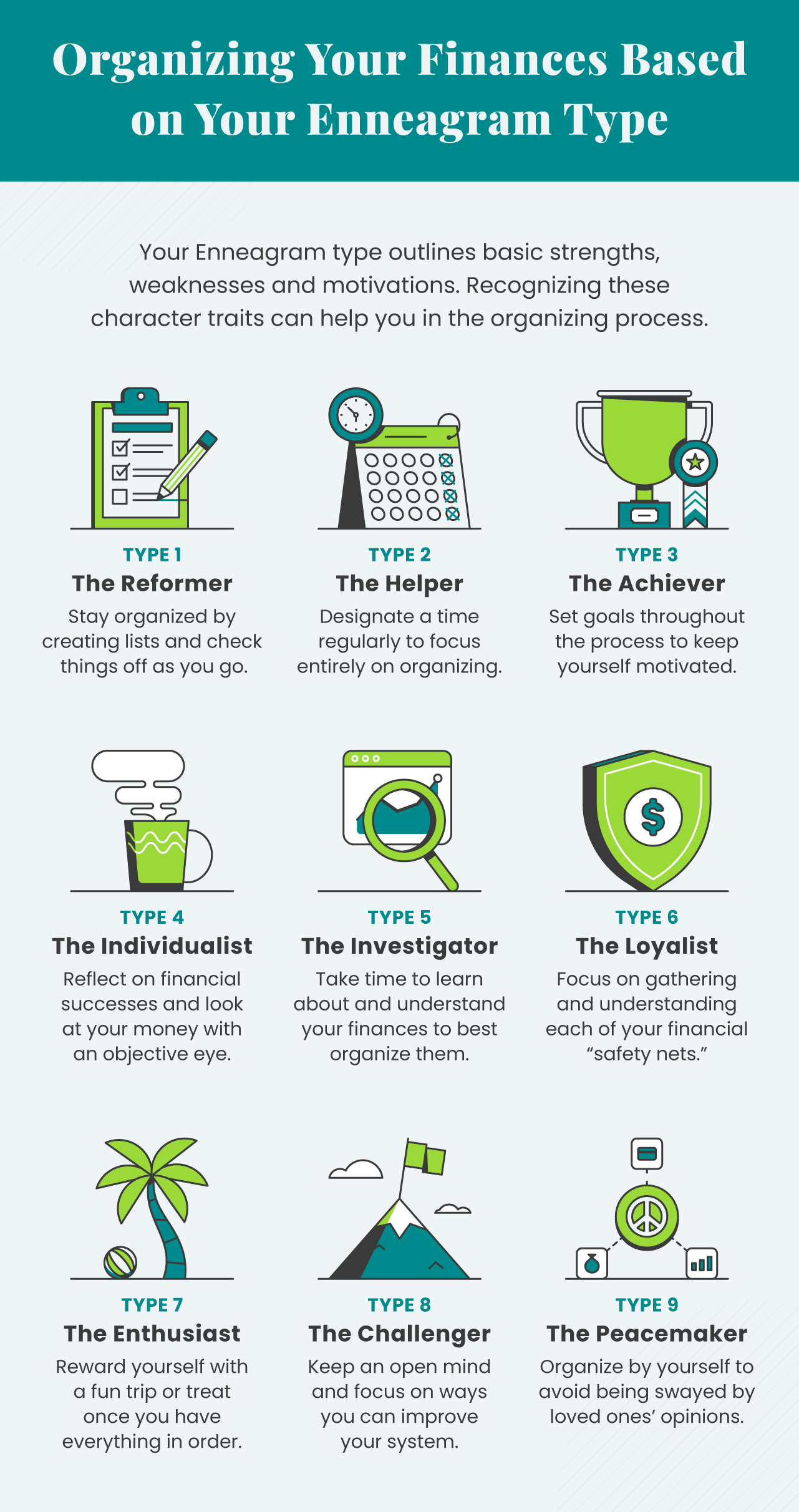

By spending adequate time getting your finances in order, you’ll be better able to pay bills on time, you’ll stress less, and you’ll have more time to spend focused on what matters most. There are many ways and methods for organizing. First look through the Enneagram chart below to get a better sense of what you should focus on based on your personality type.

Once you understand how you best organize, follow the following five steps.

1. Gather All Your Financial Documents

Knowing where your important financial documents are can lessen stress during emergencies. Be sure to organize both your paper documents and your digital documents. You can arrange them by date, category, or whatever other way helps you.

You may also want to consider scanning paper documents and uploading them onto a hard drive. You’ll then want to put this drive into a safe for protection. This will help you get rid of excess paper storage while also protecting your confidential documents.

2. Set-Up Automatic Bill Pay

By setting up automatic payments, you won’t have to spend the extra time worrying if you’ve forgotten to pay your bills. Utilizing automatic payments is one of the most effective ways to organize your bill-paying system.

Not all your bills may have an automatic payment option. For the ones that don’t, consider marking the day they need to be paid on a calendar you look at often. It can also be helpful to set up reminders in your phone.

3. Set a Recurring Date to Review Your Finances

By designating a specific date each month to review your finances, you’ll be able to better protect yourself from fraud and overspending. Doing a regular check-up will help you see where you’ve spent your money and how much you have left in your budget.

Set up reminders in your phone or project management app so you don’t forget. You can also use a paper calendar if you use it often and it will act as an efficient reminder.

4. Use a Finance App

Most people have more than one account to keep track of. From your checking account to your retirement accounts, it can be difficult to know what’s happening with each one of them. By using a finance app, you can better keep track of your overall financial picture. Many of these apps even have additional features that can help you track your net worth.

5. Create An Income Timeline

Creating an income timeline can help you set goals for your financial future. This is an especially beneficial way to organize your finances during retirement, as you’ll likely have access to different funds at different times.

Use this free printable from Annuity.org below to create your income timeline.

Getting your finances organized can seem like a daunting task, but it doesn’t have to be. Taking the plunge and getting started is often the hardest part, but knowing exactly what you need to focus on can help you break through the mental barrier and get your finances in order once and for all.