A resource for those seeking information on organizing and transforming spaces.

6 Ways Home Decluttering Can Help You Save Money

Clutter is more than an eyesore. Going home to a littered place after a hard day at work is disheartening. But a disorganized space will drain you not only emotionally but also financially. That’s because it could be a sign that you’re spending too much on things you might not need.

Clutter is more than an eyesore. Going home to a littered place after a hard day at work is disheartening. But a disorganized space will drain you not only emotionally but also financially. That’s because it could be a sign that you’re spending too much on things you might not need.

So, spare some time on the weekends or schedule a bi-monthly clean-up to declutter, and you'll find yourself less stressed and with more money. If you don’t know where to start decluttering, then check out these tips!

1. Take Stock Of Your Belongings

When you declutter, you never know what you'll uncover—you could find cash, uncashed checks, and gift cards stowed away in places you never thought to check. You might even find a stock certificate of IBM that your granddad bought 20 years ago.

Decluttering your storage room will lead to discovering items you forgot you bought. You'll minimize buying things you need until it is essential. You'll also avoid owning multiples of each item because you’ll know exactly what you have and what you don’t.

You can toss out the items you don’t need. But you can save the other usable items. Reusing and repurposing things you already own is a great way to save money. Imagine not having to buy a new pair of heels with every wedding invitation. You also can get creative with how to reuse those old buckets.

2. Make Money With What You Don't Need

You don't have to toss away all of your unwanted goods. Putting aside items to sell when decluttering can help you earn money. For example, try selling slightly used or unused items on Facebook Marketplace and eBay. You may hold a yard sale or network among your friends and relatives to see if you can sell some of your belongings. It is an eye-opener when you sell your stuff for a few bucks compared to how much you bought them originally. You will realize how much you could have saved if you didn't buy things you wouldn’t use.

3. Avoid Spoilage, Declutter The Fridge

It isn't easy to find what you're searching for when your refrigerator or pantry is packed. Worse, it's difficult to recall what's in there. It can be an absolute disaster, and you'll have to embark on a search to discover what's behind a lingering stink.

In this case, having a decluttered pantry, freezer, and fridge will prevent you from buying too much of the same item and prevent your food from going bad. Checking out your fridge can also help you plan your groceries for next week. For busy individuals, try setting up a weekly meal plan. You'll be amazed at how organized your refrigerator will be and how many bucks you'll save.

4. Eliminate Storage Costs

If you have items in storage, schedule a visit to clean the area and see what you can get rid of—otherwise, you're just paying for your junk to sit there. Eliminating storage costs is one of the easiest ways to save money. The average price for a storage unit can be under a hundred to several hundred dollars, depending on how wide the storage is. The monthly costs of storing your things can pile up quickly. So, when you clean your home, don't find another place to shove all that stuff in. But if you have to, keep checking on it and dispose of what you don't need.

5. Consider Downsizing

Decluttering is an opportunity to change your lifestyle. When you have fewer possessions, you don't require as much room. You don't need nearly as much storage or closet space. You may even discover that you don't require as much room. Recognize that certain rooms in your home are rarely utilized and may not even be needed for your needs. It can trickle down to renting a smaller space, paying fewer utilities, and even mortgage, inevitably saving money. Downsizing to a smaller home needs careful consideration, but it will only become clear that it is possible after you declutter.

6. Go Paperless For Your Bills

We've saved the best for last because this one is more of a tech-savvy strategy and it can aid in improving your financial health. It is unavoidable to have a bill or two get mixed in a pile of documents at home. If we miss payments, we'll be paying for more if only we got organized. Declutter your pile of bills on top of the paper by getting them sent to your email. By doing this, you will have no trouble organizing what has to be paid. Better yet, automate your payments. It will save you time and money to keep your bills paid on time.

Final Thoughts

You grow better at keeping track of our objectives, habits, and expectations when you have a well-organized house. In summary, decluttering gives you a clear view of what you have, helps you make money, prevents spoilage, and reduces storage costs. It will also help you in the long run by informing decisions to downsize or go paperless. All these efforts save money and time. Besides, it's good for your emotional health.

If you have trouble organizing by yourself, virtual organizing can help you. This will give you more time to focus on the things that matter. At House to Home Organizing, you’ll get your home decluttered without worrying about breaking the bank.

5 Steps For Organizing Your Finances

From organizing the living room to getting the kitchen in order, there are a lot of things that beg for your attention on a regular basis. It’s easy to spend all our efforts focused on the things we have to look at every day, but there are other areas of life that deserve just as much attention. Your finances being one of them.

From organizing the living room to getting the kitchen in order, there are a lot of things that beg for your attention on a regular basis. It’s easy to spend all our efforts focused on the things we have to look at every day, but there are other areas of life that deserve just as much attention. Your finances being one of them.

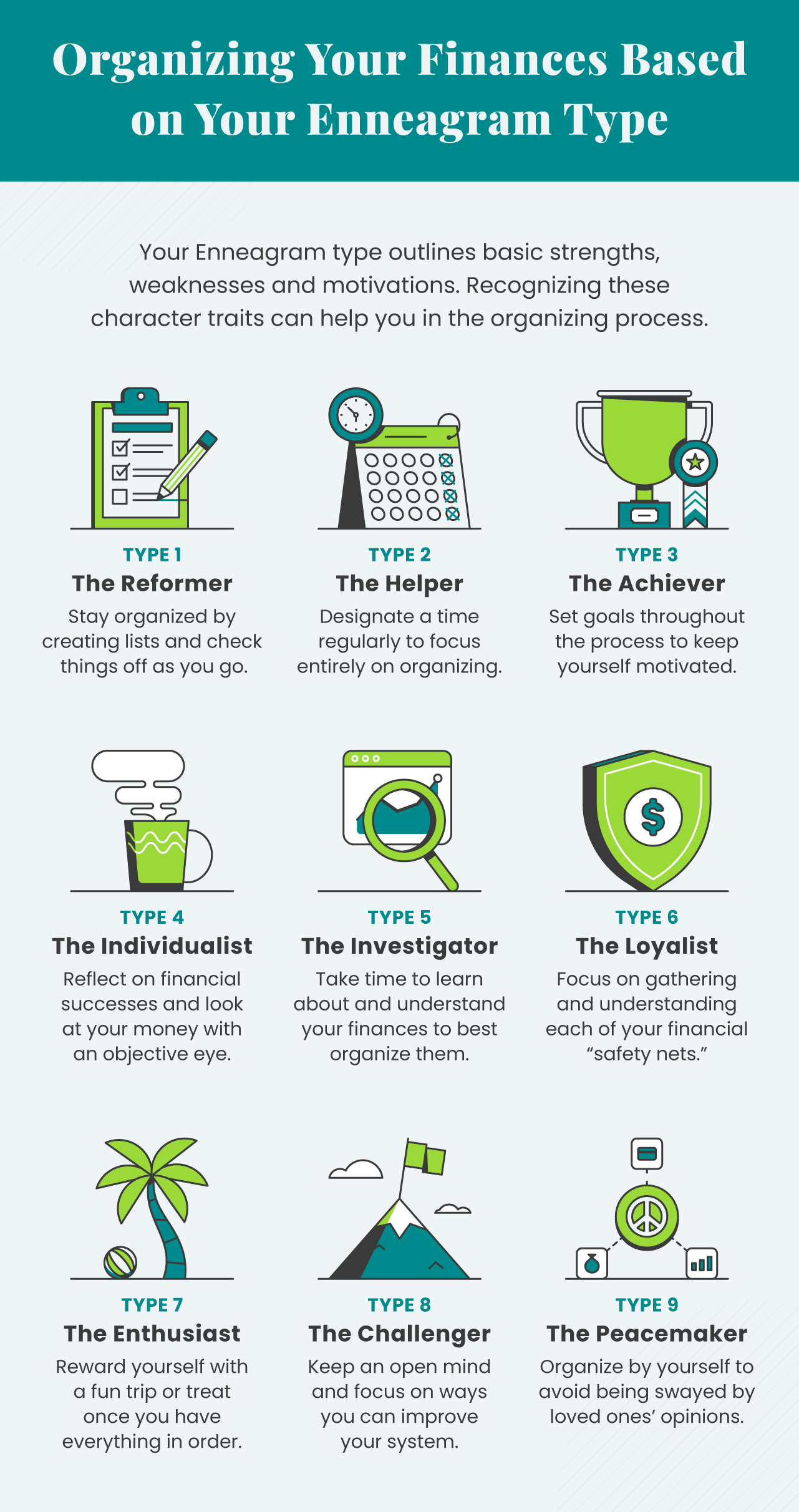

By spending adequate time getting your finances in order, you’ll be better able to pay bills on time, you’ll stress less, and you’ll have more time to spend focused on what matters most. There are many ways and methods for organizing. First look through the Enneagram chart below to get a better sense of what you should focus on based on your personality type.

Once you understand how you best organize, follow the following five steps.

1. Gather All Your Financial Documents

Knowing where your important financial documents are can lessen stress during emergencies. Be sure to organize both your paper documents and your digital documents. You can arrange them by date, category, or whatever other way helps you.

You may also want to consider scanning paper documents and uploading them onto a hard drive. You’ll then want to put this drive into a safe for protection. This will help you get rid of excess paper storage while also protecting your confidential documents.

2. Set-Up Automatic Bill Pay

By setting up automatic payments, you won’t have to spend the extra time worrying if you’ve forgotten to pay your bills. Utilizing automatic payments is one of the most effective ways to organize your bill-paying system.

Not all your bills may have an automatic payment option. For the ones that don’t, consider marking the day they need to be paid on a calendar you look at often. It can also be helpful to set up reminders in your phone.

3. Set a Recurring Date to Review Your Finances

By designating a specific date each month to review your finances, you’ll be able to better protect yourself from fraud and overspending. Doing a regular check-up will help you see where you’ve spent your money and how much you have left in your budget.

Set up reminders in your phone or project management app so you don’t forget. You can also use a paper calendar if you use it often and it will act as an efficient reminder.

4. Use a Finance App

Most people have more than one account to keep track of. From your checking account to your retirement accounts, it can be difficult to know what’s happening with each one of them. By using a finance app, you can better keep track of your overall financial picture. Many of these apps even have additional features that can help you track your net worth.

5. Create An Income Timeline

Creating an income timeline can help you set goals for your financial future. This is an especially beneficial way to organize your finances during retirement, as you’ll likely have access to different funds at different times.

Use this free printable from Annuity.org below to create your income timeline.

Getting your finances organized can seem like a daunting task, but it doesn’t have to be. Taking the plunge and getting started is often the hardest part, but knowing exactly what you need to focus on can help you break through the mental barrier and get your finances in order once and for all.

Guest Post - Practical Ways to Organize Your Finances

Here are some tips to organize your finances and help you feel more comfortable with handling them.

Dealing with finances may sound like a daunting task, but like anything else, once you get organized, it’s a lot less intimidating. The question is, where do you get started?

Here are some tips to organize your finances and help you feel more comfortable with handling them.

Gather your statements

The first step to creating a budget is to pull together all your financial statements, whether you receive them in hard copy or digital form.

Your list should include:

Utility bills — Electricity, water, gas, garbage collection, sewage

Bank statements — Where you’ll find things like grocery receipts and gasoline purchases, along with other retail purchases

W-2 forms and pay stubs

Credit card and loan statements

1099 forms detailing miscellaneous revenue

It’s a good idea to have both a neatly organized filing cabinet with all your files and duplicates stored digitally on an external hard drive or in the cloud, so they’re protected. If you store your financial data online, be sure to use a secure password to guard against identity theft.

Track your income and expenses

Once you’ve got copies of all your statements, divide them into two categories: income and expenses.

Add up all your regular income to get a total for the year. Don’t use windfalls like bonuses and tax refunds as a pretext to increase your monthly expenses. Since they’re one-time payments, put them toward one-time expenses or, better yet, toward savings or investments.

Once you’ve added up your income, make a list of your expenses. If your expenses are more than your income, see what you can cut. Look to discretionary items like streaming services, subscriptions, clothing, evenings out (sporting events, movies, concerts), books, games, and electronics. If you add to your income by getting a raise or side income, you can add some of those items to your budget again.

Once you’ve got your budget in place, You’ll want to include:

Monthly expenses

Necessities like utilities, rent/mortgage, car payment, internet access, and insurance payments

Any extras you pay for regularly, such as cable TV, streaming services, subscriptions, and so forth

Regular but less frequent payments — Include things like property taxes (if you pay them), back-to-school items, regular medical and dental checkups, vehicle maintenance, estimated taxes, birthday presents, and holiday gifts. These would include any payments you make quarterly, semiannually, or annually.

One-time or occasional expenses — Entertainment like movies, eating out, going to concerts, or weekend trips

Things to save up for — Vacations, retirement, children’s college expenses, investments

You can use an old-fashioned spreadsheet to organize your finances, or you can find a wealth of digital resources you can download. PC Mag has compiled a list of the best digital options.

Create a regular budget

Once you’ve got everything mapped out, you’re ready to set up a regular budget. You can do this with a spreadsheet program or with the help of a budgeting app. Several are available, depending on your specific situation and needs.

Among other options, you can choose budget apps that are:

Free to use

Designed to help you invest and build wealth

Meant to guard against overspending

Intended for couples working together

Built for small businesses

Intended to encourage savings

If you prefer to do your budgeting with pen and ink, you can also print out PDF templates. Keep past months’ budgets, your current month’s budget, and blanks for future months in a handy three-ring binder for easy access.

If you work on commission, and your income varies from month to month or season to season, use times when you’re doing well to set aside a cushion for the lean times and work to balance things out.

Set up automatic payments

In addition to budget apps. look for other electronic methods to simplify the budgeting process. Set up automatic bill pay with your bank for any monthly expenses that cost roughly the same amount from month to month.

Sign up for withdrawal or payment alerts to confirm any debits to your account. This can help you monitor any potential fraud or identity theft before it gets out of hand. If you see any withdrawals or charges you don’t recognize, you can dispute them with your bank right away.

Low-balance alerts, meanwhile, can let you know if your account is in danger of being overdrawn. But don’t rely on them as a substitute for tracking your expenses.

Check your account balance daily, and look over your monthly balance report for any trends that show you’re overspending (and on what), or putting more money away than you thought. If these trends persist for more than a month, you can adjust your budget to reflect them.

Of course, there’s nothing wrong with the old-fashioned method of keeping track of checks with duplicates, receipts, and a ledger. Monthly statements can come to you via mail or electronically too.

Stay on top of your credit

Any credit card purchases should be part of your regular budget, not a way to spend “outside the lines.” That doesn’t mean you should shy away from using credit, however.

Building good credit can give you a way to qualify for a mortgage, car loan, or home-repair loan down the line, and you can incorporate that into your financial plan then. In the meantime, check your credit report (you can do so for free once a year) and see where you stand.

If your credit is damaged or you need to start from scratch, one option is a secured credit card, which will give you access to a line of credit that’s tied to an initial deposit of a few hundred dollars. You build your credit as you use the card and make on-time, regular monthly payments.

If you use credit, try paying off all your balances at the end of each month to avoid interest charges.

Getting your finances organized isn’t rocket science, but it does require a comprehensive approach that incorporates attention to detail. Once you understand how to balance these approaches, you’ll be one step closer to financial stability and in a position to improve your standing.

By Ann Lloyd, Student Savings Guide

4 Way to Make Money With Your Home

When you purchase a home you own an illiquid or non-liquid asset, which means that it can’t be converted to cash easily. That being said, it does not mean you can’t make money off your house to help pay off your mortgage or to simply have supplemental income.

We partnered with a financial company for this post. The opinions in the post are honest. All reviews and opinions expressed in this post are based on our personal views. We are excited because we know you will love it.

When you purchase a home you own an illiquid or non-liquid asset, which means that it can’t be converted to cash easily. That being said, it does not mean you can’t make money off your house to help pay off your mortgage or to simply have supplemental income.

Here are four easy and creative ways to make money off your house.

1. Rent Out a Room

This might seem obvious, but renting out a room, guesthouse, or backhouse of your home is an easy way to help pay off your mortgage by having immediate and consistent cash flow each month. Furthermore, roommates help split your utility costs and can help with chores around the house, which saves you both time and money.

A good rule of thumb is to charge 0.8–1.0 % of your home’s market value per month for each roommate. For instance, if your property has a value of $500,000 then your rental rate should be between $4,000 and $5,500 per month.

That 0.2% percentile difference does have an impact. So, it’s suggested that if your property’s value is under $375,000 then charge closer to 0.8% while if your property value is over $375,000 consider a rate closer to 1.1%. You can always look into Financial Services Outsourcing for guidance.

2. Offer Storage Space

If you have an external shed or a garage that isn’t used, then contemplate renting that space out as a storage unit. On average, storage units cost $90.00 a month. In most cities, there are plenty of people in search of affordable alternatives.

You have options when it comes to renting out a storage space. You can allow short-term rentals for college students between breaks or those who are moving in-between spaces and need to temporarily store their belongings. Alternatively, you can rent out an entire garage or driveway to a boat, RV, or camper.

3. Charge for Parking

This option is very much location dependent, but in densely populated areas you might want to share your driveway or parking space for short-term or long-term. Furthermore, if your home is near popular weekend events such as sports events or a music venue, then you can charge people to park in your driveway. If it’s a group of related people, try to charge for multiple parking spaces since they can block one another in.

This can easily add up to several hundreds of dollars for each event.

4. Create Products + Get a Tax Deduction

If you’ve always wanted to launch your a personal small business then why not start from home? No, you don’t have to be the next computer whiz building cutting-edge technology in your garage. You can though follow your passion or side hustle and use a space within your property to create your own business. Here are some ideas:

Bake treats and deserts

Create jewelry

Produce artwork

Refurbish or construct wood

Even better, depending on the space, you can get a tax deduction for having an exclusive business space. Just make sure that your home business meets any certification, licensing, or permit requirements.

For more unique ideas on how to make money with your home, see Homebuyer’s visual below.